16.14. Proof of Stake¶

16.14.1. What is a consensus mechanism?¶

A consensus mechanism is a method by which a distributed ledger is updated (that is, a new block is added to the block chain), and all parties come to agreement that this did happen. For more information, see consensus.

A consensus algorithm differs from a consensus mechanism in that a consensus algorithm is the series of instructions that are executed on a given node in the network, whereas the mechanism refers to the collective action of multiple nodes in a network operating to reach consensus on what blocks to add to the blockchain.

16.14.2. Block Structure Review¶

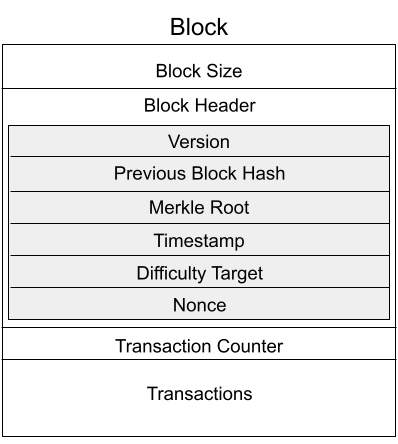

A blockchain is a series of blocks linked by hash pointers (pointers that each have an associated hashcode). A block has a header and a footer where the header contains information related to the identity of the block such as the creation time stamp and reference to the block before it. The footer contains data such as a collection of transactions. For more information, see blocks.

16.14.3. Why do we need proof of anything?¶

Previously we presented the Proof of Work mechanism, popularized by the Bitcoin protocol. This is not the only means of achieving consensus in a distributed ledger. The Ethereum network is currently in transition to a version of the Proof of Stake mechanism. But why do cryptocurrencies require a consensus algorithm in the first place and why must there be a ‘burden of proof’?

The short answer: Economic civil resistance. If you have a network consisting of hundreds, thousands, or millions of participating nodes, it is necessary for the community to on the order in which transactions are processed. At the highest level, it is necessary to have a mechanism that decides who can participate in deciding the order of transactions. In Proof of Work, it is whomever is first to provide a legitimate block (which takes a lot of work—or luck—to produce). In Proof of Stake, it is more like a voting mechanism. How this voting mechanism works is where things get complicated for many crypto protocols.

The first requirement to any protocol that involves voting is a process for determining what entities get to vote. If anyone who wanted could vote, than potentially an individual could spin up hundreds of billions of virtual nodes that claim to be voters in the network, possibly creating a majority of votes and controlling the network.

Proof-based consensus mechanisms issue network control authority proportional to each node’s control of a designated economic resource. In the case of Bitcoin’s proof-of-work mechanism, that economic resource is one’s ability to compute a valid solution to expensive hashing-related problems. While there is some element of luck to Bitcoin’s proof-of-work protocol (essentially, miners keep guessing until they are lucky enough to guess correctly), in the long run it is a measure of computing power as an economic resource (to make as many guesses as possible in a given period of time).

Proof of stake, rather than using algorithmic complexity and computational resources as a measurement of voting authority, uses amount of an underlying token or asset to denote control in the network.

16.14.4. What is Proof of Stake?¶

Proof of stake is a way for an entity to validate (that is, claim the right to add) a new block to a distributed ledger. Proof of Stake is in contrast to the Proof of Work approach used in BitCoin. Proof of Stake is used by the Ethereum cryptocurrency since December 2020, and its most important distinction is that this validation process does not require “mining” in the sense of expending a significant amount of computing resources to claim the right to validate (and add) the next block. To indicate the distinction, the process of making the claim to validate the next block (and thereby gain the associated coin as a reward for this contribution to the community) is referred to as “forging” instead of “mining”.

Other cryptocurrencies that uses proof of stake as their consensus algorithm include Peercoin, Tezos (XZT), Binance coin (BNB), NEO, PIVX, Neblio (NEBL), Cardano (ADA), and Stratis (STRAX).

16.14.4.1. How does it work?¶

This section attemtps to provide a high level, chain agnostic summary of how proof-of-stake works. Specific implementation details will vary greatly on different networks. Unlike proof-of-work, which is relatively simple and fairly settled in its implementation, Proof-of-Stake as a viable approach to consensus is still evolving. Thus, it is hard to say “this is how it works”. But we can give a current example.

Much like in the traditional Proof-Of-Work mechanism, in the current case of Ethereum, a block typically consists of around 70 transactions. Unlike Proof-Of-Work where miners are competing for the correct solution necessary to append this block to the chain, the Proof-Of-Stake mechanism is more efficient in that it selects a validator who is responsible for proposing a block to the chain.

Who is a potential validator, and how does the next validator get chosen? A validator is any participant in a proof-of-stake network who has staked a sufficient amount of the network tokens. In the case of the Ethereum network, 32 ETH is the minimum amount of staked assets required to become a (potential) validator node. The next validator is selected by a pseudo-random algorithm which elects the next chosen validator in proportion to how much currency each member of the potential validator pool has staked. What this means in essence is that if one validator has 32 ETH staked while another has 320 ETH staked, over the course of a long period of time, the second validator will be chosen 10 times more often than the first validator on average.

In the Ethereum implementation, the validation process involves what is called a committee. A committee is a collection of pseudo-randomly chosen validator nodes that are all collectively responsible for proposing the next block.

A common vehicle used to improve one’s opportunity to participate in being the next validator is a staking pool. Staking pools are groups who combine their coin together to increase their collective stake, and therefore their chances of their pool being chosen as a member in the next validator committee. While this pool is made up of assets from (in some cases) hundreds of thousands of individuals, the pool itself serves as a singular validator node on the network. Assets can be added to a staking pool at anytime; however, the pool must lock up assets for a set period of time depending on the network protocol used. The amount of time your assets are locked up for is referred to as the bonding period. Some networks will have a variety of bonding periods available; for example, ETH 2.0 has staking protocols that require assets to be locked up for multiple years, while other staking protocols can have bonding periods as short as 14 days.

The reason that an individual might stake some coin to compete for a place in the next committee (or might join a staking pool) is that when the committee successfully has a block added to the blockchain, they receive a reward (as explained in the discussion on Ethereum gas).

The process of validators adding a new block to the blockchain occurs in three phases: proposing the block, voting on the block, and adding transactions to the block. As discussed previously, the validator is selected in proportion to how many tokens they staked. After being selected, this validator is responsible for proposing a new block. The remaining committee members’ job is to vote on the proposed block and attest to transactions within the block. It is the committee’s responsibility to vote on whether or not the newly proposed block is legitimate and should be included in the chain.

What exactly are committee members looking at to see whether a proposed block is valid? There are many points of validation necessary to ensure the block is valid, and these vary from chain to chain. An obvious criteria for validity is adherence to the format specification of a block, much like packets being sent over an internet connection must adhere to a particular format. An additional check that can be performed is comparing the previous hash of this block to the hash of the most recent block on the chain. More advanced block verification processes can exist on different chains; however, these two are the most common high-level validity checks performed.

So long as the committee has voted in majority approval of the proposed block, that block will be appended to the chain. We will cover what happens when a block is rejected later on.

Following successful addition of a new block to the chain, the validator process starts over. This entire process will repeat over a set period of time known as an epoch. Epoch length will vary based on the given network; however, in the case of Ethereum a new block is appended roughly every 15 seconds (far faster than BitCoin). An important note is that even if a block is approved and appended to the master-chain, it can be still be invalidated later on (for a limited period of time). After an epochs is completed, the added block still has two remaining slots for transactions before all of the transactions in the block are considered final and cannot be reversed.

The following slideshow visualizes the committee approval process.

16.14.5. Proof of Stake versus Proof of Work¶

16.14.5.1. Where does the Money Come From?¶

Any consensus protocol must have some form of incentive for users to participate in the protocol; otherwise, there would likely be no way to validate new transactions. Similar to Proof-Of-Work, Proof-Of-Stake rewards validators with newly minted tokens as new blocks are appended to the chain.

The specific reward schema differs greatly between blockchain infrastructures; however, at a high level the process used by all Proof-Of-Stake based environments to reward validators is identical. Both the block proposer and the validators who attest to the validity of the proposed block will share some percentage of the newly minted tokens. The amount of tokens that are minted with each new block depends on the issuance rate of that given protocol.

16.14.5.2. Performance / Reliability¶

All distributed ledger systems require both computation and network interaction to succeed. No decentralized network can function without nodes in the network that conform to a pre-determined protocol. How can a decentralized system maintain uptime and reliability without any centralized control over the network nodes? Consider a traditional software system like Google.com. If Google has a major server outage, their services fail to function and users suffer. Google has direct control over their servers and can take action to fix the problem or avoid it from happening in the first place. With a decentralized system, that level of direct control over hardware uptime does not exist.

In the case of a POW-based network, miners are encouraged to propose new blocks for the block chain based on the promise of a reward for providing the next accepted block. This incentivizes all network participants to continue both making transactions and for miners to continue mining. In the case of POS-based networks, there also exists a reward mechanism for validator nodes when they are selected by the network to propose a block. Unlike proof-of-work, proof-of-stake relies on the validator node to uphold its obligations to the network whenever it is called upon to do so. So what happens when a validator node is selected to propose a block, but either fails to do so or does so in a way that is not valid?

This introduces the concept of Slashing, where a validator node is punished for not fulfilling its obligations.

16.14.5.3. Slashing: Incentivizing Legitimacy¶

Slashing is an important feature of Proof of Stake, as it incentivizes validator nodes to perform their block proposal duties in accordance with the set rules and regulations of the given chain.

Proof of Stake retains decentralization by way of the committee voting process. Committee members can expose a malicious or ill-configured validator by voting against their proposed block as explained above in the How Does It Work section.

Upon discovery of a malicious or ill-configured validator node, the deficient validator will be punished by way of slashing. The specific implementation details of slashing vary from chain to chain; however, in practice, either all or part of the validator’s staked assets will be seized and not returned to them as a punishment for failing to adhere to the network protocol.

16.14.5.4. Security Concerns¶

For both Proof of Stake and Proof of Work consensus mechanism, various types of attacks are a risk to the system. “51% attacks” can be made by users or user groups that own more than 50% of some critical resource. For Proof of Work algorithms, it means that someone controls 51% or more of the mining cycles. For Proof of Stake algorithms, this means that one individual or group in a stake pool maintains control of 51% of the total staked tokens in the network. An important distinction is that in this case, it is 51% of staked tokens, not of all tokens owned by all participants. For example, it is estimated that the average PoS network has around 70% of the total token supply staked. This implies that a single user can acquire majority control over the network by only holding around 35% of the total token supply.

For both algorithms, this form of attack enables a singular party to retain control over the next block that will be added to the chain. If the successful perpetrator of the 51% attack has injected a malicious transaction, then it will be accepted as the malicious party retains sufficient voting power to accept any transactions they desire.

Examples of things that can occur in a 51% attack include preventing valid transactions from receiving verification (and so being added to the chain). Imagine you are trying to sell ETH on a public exchange like Coinbase to liquidate your assets. If a malicious participant wishes to prevent liquidation, they can block the blockchain transfer of coins, which would in turn prevent you from selling any of your tokens.

A second attack vector, and more common, is double spending. If verification of some transaction does not occur in a timely manner, then an alternative transaction can get onto the blockchain that spends those same coins (effectively allowing a malicious user to re-spend coins).

51% attacks are difficult to recognize until after the attack is executed. Detection can occur when duplicate transactions or repeating refunds are found in between the blockchain and the proposed new block.

In a Proof of Stake system, a 51% attack is discouraged by slashing. Those who participate in such an attack will lose part of their stake or coin if it is caught. This means at a minimum that the attacker gaining a chance at validating in the future are reduced since the have less coin to stake. See cryptohacking for more information related to crypto hacking.

The most obvious reason as to why double spending will eventually be caught is because following a successful double spend transaction, all nodes on the network will be able to see and clearly identify this fraudulent transaction. A number of things may take place after this has been identified, but most immediately, the price of tokens will drop as individuals recognize the system has been compromised.

This drop is actually beneficial for the network as it enables more validators to rapidly come online and displace the majority control that one entity had over the network. Once the malicious party loses majority control of the network, new validators would be able to repeal the previously added block and slash the staked currency of the malicious validator.

What this means from a practicality standpoint is that any malicious actor engaging in a double-spending attack would need to double-spend MORE currency than what they can potentially lose from a slashing. In most PoS systems, it would be impractical to double spend more than the amount of tokens necessary to acquire majority ownership over a network as this is usually a large portion of all coins in the system.

Slashing is just one way that majority validator abuse can be combatted. Another means the community has to fight abuse is through forking. If enough members of the community agree that the chain has been compromised and is no longer accurate, they can decide to fork the chain at the last known point of legitimacy and start a new chain in which the malicious actor has no stake. Common examples of forking include Bitcoin and Bitcoin Cash wherein there was a divergence in community beliefs regarding what the future of the token should look like. As a result, two separate chains emerged.

While technically possible, attacking a proof of stake network is made feasibly unobtainable due to the social and logistical implications of what may occur.

16.14.5.5. Energy Concerns¶

Proof of stake addresses concerns with the environmental impacts that proof of work causes. Proof of work requires a large amount of power to run the mining algorithm (i.e, many, many guesses at the nonce until finally finding one that works). This power translates into higher amounts of electricity used and increases the demand for utility providers to create more. For example, in 2016, the cost of a transaction in the bitcoin network was about 830 kWH of energy consumption where the network processes around 5 transactions a second. This means that in one second of transactions, 4,150 kWH were consumed. When the value of the cryptocurrency increases, the energy cost consumed rises because of the higher incentive to mine new cryptocurrency leading to more mining. This growth is so significant as to make this approach unsustainable in the future.

In the proof of stake algorithm, computation power is effectively replaced by the stake of the user. There is no need for high computing power when attesting for new blocks, meaning the environmental cost is decreased. Instead of computational resources being used as a source of scarcity, the users’ own tokens are staked. One notable drawback of this is that in order to participate in the validation process, a user must own some amount of tokens already. In PoW, a new miner can begin accumulating coins simply by allocating some amount of computational power.

16.14.5.6. Risks of Concentration¶

For proof of work algorithms, a business or group of individuals can collect coin by mining with several computers. Because of this collection of resources to one group, potentially a single group could own the majority of the mining power (i.e. Bitcoin for some investors in China) with no extra cost of bitcoin other than the cost of mining them.

For proof of stake algorithms, when an individual is investing in more cryptocurrency, they must put some percentage of their coin in exchange for a chance to be selected for the validation committee. This exchange is a holding similar to investing in stocks. The user may get this back when they attest for the right blocks in the currency. The coin not invested in the stake can be used for transactions. This means that an individual with a large amount of wealth could invest more for higher gains. An individual or group with lower investment availability has a lower rate of return since there is a lower chance of being assigned to a committee. However, even if an individual with a large stake invested in the cryptocurrencies, will still not have a majority since the value of the cryptocurrency is more than the individual’s worth. If the cryptocurrency equates to an individual’s worth, it would be easy to invest higher pecentages in stake and increase chances of being chosen for validation committees where, if the user has malicious intent, they can initiate the 51% attack.