16.17. The Ethereum Virtual Machine and Gas¶

16.17.1. Ethereum Virtual Machine¶

16.17.1.1. Introduction¶

What is the Ethereum Virtual Machine (EVM)? The EVM acts as a distributed computer running the underlying framework of Ethereum’s operating structure. You can think of Ethereum as a single entity mantained by thousands of connected computers running a copy of the EVM. This entity is a blockchain, and we can describe any given block in the chain as updating a “state” defined by the blockchain to that point. The rules for changing state from block to block are defined by the EVM and are covered in the rest of this section.

16.17.1.2. Ethereum State¶

Before we get started, let’s define a few terms:

1. Transaction: Something that changes data within the blockchain. Common examples of this are changing account balances (sending ETH to someone else) or editing data within a smart contract.

2. Block: A blockchain is composed of blocks, which are each filled with transactions.

Ethereum State: A snapshot of the Ethereum blockchain at a point in time.

4. Global Ethereum State: The agreed upon state of Ethereum by up-to-date instances of the EVM.

Elaborating on the Ethereum State – it’s all stored in an enormous data structure. The data structure stores data for every account: current balance, number of previous transactions, smart contract code, etc. It also stores other data such as previous blocks and all data pertaining to them. All running instances of the EVM have a local copy of this giant data structure downloaded. Ideally, it is identical to the current consensus state, but some instances might be slightly behind due to not yet having received the latest updates through the network. This is because each EVM instance receives a new state from other EVM instances. That new state will propegate throughout the network, which takes time.

So, how does this global state update? Once a block is committed, meaning that it is adopted as the newest block in the blockchain, the global Ethereum state will transition from the previously known state to the new one (details on how a block is committed). A block being committed means that all transactions it contains have been deemed legitimate, and therefore, the giant data structure containing Ethereum’s state has been updated with the new block’s information. All running instances of the EVM must have adopted this new global state through downloading new data into their local copy of the giant data structures. So some account balances will have changed and some smart contract transactions will have been made, which all these machines must collectively agree on. Once this is complete, the block is finally committed to the blockchain and Ethereum’s state will update.

One thing to note is that the process for committing a new block onto the blockchain takes rougly 15 seconds for Ethereum. So, as with any distributed ledger, transactions aren’t instant. Only a few dozen to a few hundred transactions fill each block, and a transaction will only have completed once it is included in a block. So why 15 seconds, instead of 1 or 2 seconds (which might seem like a reasonable time to propogate through the network)? Well, the mean time to propagate new data across all running instances of the EVM is 12.6 seconds. Additonally, the process by which a block is proposed needs to take place (previously this was a form of proof-of-work, but in December 2020, Ethereum changed it’s consensus algorithm to proof-of-stake).

Thus, we are able to describe Ethereum as having the state transition function Y(S, T)= S’. Given an old valid state (S) and a block of valid transactions (T), the Ethereum state transition function Y(S, T) produces a new valid output state S’. All running instances of the EVM will adopt this new state, and continue onward processing transactions.

Brief description of the enormous data structure:

A modified Merkle-Patricia tree stores the Ethereum state. The tree is essentially a giant key-value map, where every key is an Ethereum address and the value is an array containing account data. Specifically, it holds account balance, number of previous transactions, and two hashed fields pertaining only to smart contract accounts. For regular accounts, these fields will be empty. For smart contracts, one field is a hash of a piece of the smart contract code, which is executed if the account receives a message call (a read only operation). The other is a hash of the root of another Merkle-Patricia tree, called the Account Storage tree. This tree is where all of the smart contract data is stored.

16.17.1.3. Smart Contract Refresher¶

There are two types of accounts designated addresses on the blockchain: Externally Owned Accounts that most people own to send and receive ETH, and Contract Accounts which contain a smart contract compiled down into bytecode. Both of these account types are given addresses, can receive, hold, and send ETH and fungible tokens, and can interact with smart contracts. Smart contracts are written in special-purpose programming langauges. One popular language one being Solidity. Here is an example Solidity code snippet.

This code snippet is an example smart contract with a function that lets a user set a local variable and retrieve it. It can be thought of as a storage, hence the contract name, “SimpleStorage”. In a realistic smart contract, someone might store a party that agreed to a legal document.

A developer can put whatever data and functions they desire inside of a smart contract. Once a smart contract is put onto the blockchain, code within it is immutable. However, functions are able to be called through third-party software. If these functions change data within the smart contract, they will change the blockchain’s state and are considered transactions. In the example above, calling the function “set” would be considered a transaction since it changes data within the smart contract. Calling “get”, however, would not be since it only reads data.

Since smart contracts are so customizable, multiple different applications of them have arisen. For example, the most common use of smart contracts is to transfer a non-fungible token(NFT). The most popular smart contract for doing so is ERC-721, which is a standard for NFTs. It has functions like transfer(current_owner, new_owner, NFT_id), ownerOf(NFT_id), and more. When someone purchases the NFT, the transfer function would be called to transfer ownership of the NFT to the new address. This will change data inside the smart contract, so it is considered a transaction. If you call the ownerOf function to find the owner of an NFT, it won’t modify blockchain data, and won’t be considered a transaction.

Smart contracts are also how fungible token ownership gets incorportated into a blockchain. A fungible token is the opposite of a NFT – meaning that every token is the same. This is what Ether, or Bitcoin, or any other coin on a blockchain is. You are able to trade one coin for another, as they all have the same value. The most popular standard for implementing one of these coins is ERC-20, and a coin must implement specific methods to be considered an ERC-20 coin. Any one of these coins would have metadata such as the total supply of the coin, the coin’s symbol, if the minting is finished, etc. It would also have a function to transfer coins between addresses, and these addresses are either the same as Ethereum addresses or a mapping of an Ethereum address. Some of these coins include $USDT (Tether), $SHIB (Shiba Inu), $USDC (USD Coin), $UNI (Uniswap), and more. You can take a look at all coins built on top of blockchains here: https://coinmarketcap.com/tokens/views/all/

16.17.1.4. What does the EVM do?¶

Before we get started, let me define an Ethereum node. A node is a computer running an instance of the EVM that someone has set up to verify all transactions in each block. This means the node will ensure no requests are malformed, all accounts are valid, etc. So what’s the difference between a node and a miner? Well, all miners are nodes, but not all nodes are miners. Miners have the ability to validate blocks as a whole through the proof-of-work consensus algorithm, while nodes cannot. Note that this pertains only to the proof-of-work protocol.

Ethereum changed to a proof-of-stake protocol in December, 2020. So, the following description relates to the previous proof-of-work protocol. Once a transaction is made anywhere on the Ethereum network, it will be sent to a node. That node will broadcast this transaction to all other nodes, and it will be added to every nodes’ list of pending transactions. This is called the nodes’ mempool: a list of all transaction requests that haven’t been committed to a block yet. At some point in time, a single miner will collect a few dozen to a few hundred of these transactions from its local mempool into a potential block, in a way that maximizes the gas fees attached to each transaction. Then, the miner will verify each transaction, execute its bytecode to perform the transaction on their local version of the EVM, then collect the transaction’s gas fee. Finally, the miner will begin the proof-of-work process to produce a certificate that shows the block is valid. Once completed by the miner, that miner will broadcast the new block, the certificate, and a checksum of the new EVM state to all other nodes. Then, every other node will validate the proof-of-work certificate and re-approve all transactions in the block. This includes the transactions to pay the miner their collected gas fee from the block. Once validated, the node’s local state will update to include the new block, and it will continue propegating through the network. In general, once a node has propegated throughout at least 51% of the network, we can say the global state of Ethereum will transition to include the new block.

In the proof-of-stake protocol, all mentions of gas being collected by miners are instead collected by validators. The process for adding a new block essentially stays the same. The difference between the prior proof-of-work protocol and the new proof-of-stake protocol is the exact process used to propose the next block.

16.17.2. Gas¶

16.17.2.1. Introduction¶

Gas keeps the Ethereum blockchain safe. It is what also allows (previously) miners (now) validators to profit, and provides incentive for doing the necessary work of proposing the next blook of transactions for the blockchain. So, what exactly is gas, and how does it work?

Gas is a fee placed on top of any transaction on the Ethereum network, which is paid directly to the miner or validators who is making the effort to validate and execute the bytecode of a transaction. Gas also keeps the network safe through stopping an attacker from overloading the Ethereum network with transactions, elaborated on here.

16.17.2.2. Cost of Gas¶

- Two factors determine the amount of gas required by a transaction:

The complexity of the transaction

- (static blockchain transaction vs smart contract)

The current load on the Ethereum network

Let’s start with the first factor. The normal way to update a Blockchain is that a block filled with transactions is proposed and accepted into the blockchain (via the consensus algorithm process). For each of these transactions, a miner/validator must validate them and execute their bytecode, which is composed of instructions. The base cost to have some transaction validated is 21000 gwei, where one gwei is one one-billionth, or 0.000000001 ETH. Then, an additional fee is placed on top of the base cost, determined by the amount of instructions to be executed. Each opcode has an associated gas cost, and when executed, consumes that amount of gas (see https://github.com/djrtwo/evm-opcode-gas-costs/blob/master/opcode-gas-costs_EIP-150_revision-1e18248_2017-04-12.csv). When you get to more complicated bytecode in smart contract transactions, the amount of instructions executed drastically increases, which is why gas fees are higher for smart contracts than for static transactions.

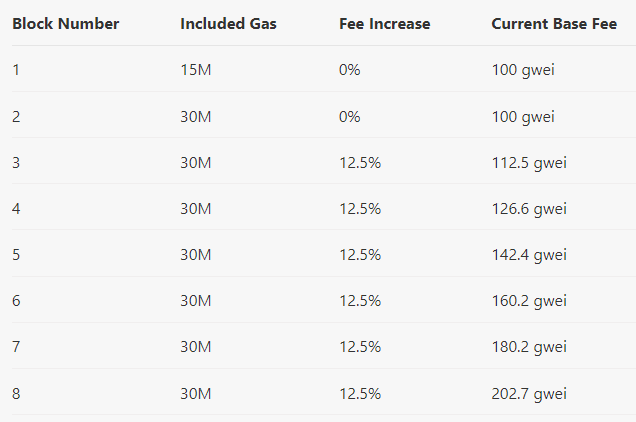

The second factor for determining the price of a transaction is the current load, or how heavily congested the Ethereum network is. The formula for calculating gas is: Gas price = Gas units * (Base fee + Tip), and we just discussed how gas units are calculated. The base fee’s price is determined by Ethereum’s network congestion. The tip is a priority fee and is set automatically by most wallets to speed up your transaction’s completion, so it’s not very important when calculating gas. The base fee for the current block is calculated based off previous blocks. When a new block is added onto the blockchain, there is a set amount of gas, called included gas, that it can hold (sum of all gas fees from transactions in the block). In the block with the lowest base fee of 100 gwei, block number 1, included gas is 15M gwei. If the included gas is completely filled, the base fee will increase by a maximum of 12.5% per block and the block number will increase.

This growth is compounding and can lead to very high base fees when there is high network congestion for extended periods of time. The block number will also decrease by 1 when the included gas is not completely filled, creating fluctuations in gas prices.

However, this is not the only reason that gas prices increase during high congestion. Miners will greedily prioritize transactions that supply more gas, so the more gas you pay, the more likely your transaction is to get included in the next block. When performing a transaction, you will be given the option to choose from a low, medium, or high priority gas fee. The lower the fee, the lower the chance a miner will pick it up, and the longer it will take for the transaction to be incorporated into the blockchain. This also means that if you pay too little gas, your transaction could get stuck. In this situation, you can either cancel the transaction and lose what you paid for gas, or pay additional gas and speed up the transaction.

16.17.2.3. Example¶

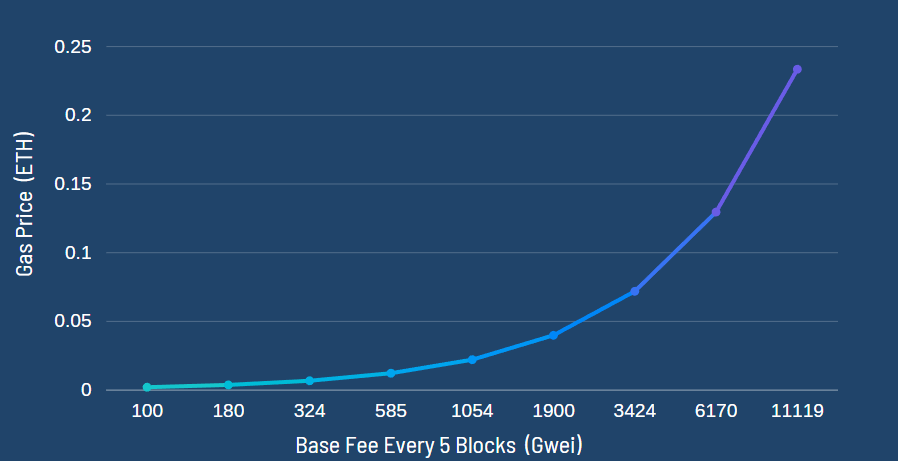

To sum up, let’s consider an example transaction scenario. Given the formula

Gas price = Gas units * (Base fee + Tip)

Let’s assume a tip of 0 and 21000 gas units for a regular transaction. This is what the gas price would be, depending on the base fee:

Recall that a higher base fee comes with higher network congestion. So you might end up paying a substantial amount of money in ETH just because the network was congested at the time! The base fee of a transaction is the most volatile number when calculating gas, so all real gas prices will be fairly reflective of this chart.

So you might be wondering why anyone would use Ethereum when fees get so high. One major benefit of Ethereum is that their fees are flat – meaning that the fee for sending $10 versus $100,000 is the same. Additionally, Ethereum tends to stay between 1 and 10 blocks, so gas prices will rarely spike to crazy numbers. Historically, gas price spikes have occured when a popular NFT is released to the public all at once, and thousands of smart contracts are attempted to be minted at once.

16.17.2.4. Conclusion¶

In conclusion, gas is a huge contributing factor to Ethereum being decentralized due to mining profits. Ethereum mining is more profitable than Bitcoin mining due to high gas fees during periods of high network congestion coupled with ~5-6x more Ethereum transactions per day since the time to add a new block to the blockchain is far less in Ethereum (15 seconds typically) as compared to BitCoin (10 minutes). This means that the network is more likely to be highly congested and miners will be paid more to validate transactions. Gas also removes incentive to attack and overload the network with transactions, as gas fees will quickly consume the attacker’s capital. If someone wanted to stall the network for 15 seconds, they would have to put enough transactions in to fill a block. The gas limit for all blocks (aside from block 1 and 2) is 30M gwei, which equates to 0.03 ETH. If you wanted to stall the network, for let’s say 1 hour (3600 seconds), you would have to fill 3600/15 = 240 blocks. This would equate to spending 240*0.03 = 7.2 ETH = ~$31,000 (as of 12/5/2021). Attackers will typically consider this an unreasonable amount of money to stall the network for just 1 hour. As you can imagine, taking down the network for any extended period of time is simply not worth it. If gas didn’t exist, an attacker’s transactions could fill blocks over and over such that no other transactions could be added into a block. This would stall the Ethereum network to the point where it would become unusable. All in all, gas is an important part of Ethereum that is necessary to keep the blockchain decentralized and running smoothly.